Therefore, unrecorded differences will change the balance in the bank book of the company. Since these differences alter the balance on the bank book, the adjustments need to take place before further reconciliation takes place. Timing differences are items that cause a difference between the balances in the bank statement and bank book due to the timing of transactions. These differences generally comprise two types of items, outstanding checks, and deposits in transits, also known as outstanding lodgments. An outstanding check is a check that a company pays another party, but the party does not present it to the bank.

Adjustments to the Cash Account

If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further. Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. As a result of these direct payments made by the bank on your behalf, the balance as per the passbook would be less than the balance as per the cash book. This means that the company’s bank balance is greater than the balance reflected in the cash book.

How do I prepare a bank reconciliation statement?

Designed to keep your bank and your G/L in balance, the bank reconciliation process also helps you correct possible errors, account for uncashed checks, and even locate missing deposits. Bank reconciliation statements compare transactions from financial records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source of errors. Cross-checking bank statements with the balance sheet at least once every month during the closing process is necessary.

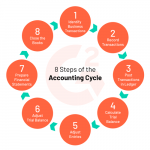

ABC Co. can start from the adjusted bank book balance a beginner’s guide to the accounting cycle and adjust the timing differences to it to reach the bank statement balance. It can also adjust the balances to the bank statement to reach the adjusted bank book balances instead. Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available. Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records.

When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference. One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts. If you want to prepare a bank reconciliation statement using either of these approaches, you can use the balance as per the cash book or balance as per the passbook as your starting point. These fees are charged to your account directly, and reduce the reflected bank balance in your bank statement. These charges won’t be recorded by your business until your bank provides you with the bank statement at the end of every month.

Preparing a Bank Reconciliation Statement

- When your business receives checks from its customers, these amounts are recorded immediately on the debit side of the cash book so the balance as per the cash book increases.

- A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow.

- While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

- In short, how often a company should prepare bank reconciliations depends on the level of activity in its bank accounts.

- The bank will debit your business account only when they’ve paid these issued checks, meaning there is a time delay between the issuing of checks and their presentation to the bank.

Keeping accurate financial statements is the easiest way to simplify your bank reconciliation process. FreshBooks accounting software helps you track income and expenses and generate reports and financial statements. Try FreshBooks for free to streamline your tax preparation and bank reconciliations today. We strongly recommend performing a bank reconciliation at least on a monthly basis to ensure the accuracy of your company’s cash records.

If you’re not careful, your business checking account could be subject to overdraft fees. Making sure a company’s and its bank’s listed balances align is also a way to ensure the account has sufficient funds to cover company expenditures. The process also enables the company to record any interest payments the account has earned or fees the bank has charged. Remember that items such as outstanding checks do not need be recorded roles and responsibilities of a company shareholder into the G/L since they are already there.

Detecting Fraud

In the absence of proper bank reconciliation, the cash balances in your bank accounts could be much lower than expected, which may result in bounced checks or overdraft fees. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile t2 corporation income tax return your bank account within a few days of receiving your bank statement.