Content

Market value is what an investor would pay for one share of the firm’s stock. For example, utility companies have highly reliable sources of revenue because they provide a necessary commodity and often have limited competition. This allows companies to take on greater debt without taking on greater risk. With a debt-to-equity ratio of 2.25, Company A uses $2.25 of leverage for every $1.00 of equity. The D/E ratio highlights how leveraged a company is, which is a risk indicator. CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

How do you calculate equity on a balance sheet?

To calculate equity on a balance sheet, the following steps are followed:

Total all assets.

Total all liabilities.

Subtract total liabilities from total assets.

Total equity may be found in the lower right or bottom portion of a balanced sheet.

Deferred https://www.bookstime.com/ taxes we generally do not count at all in this calculation. Other non-current liabilities, it depends what’s in them. Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. Equity is the value the business owners have in the business after all liabilities are paid. It is calculated by subtracting the value of all the liabilities from all the assets owned by the company.

Share Capital and Balance Sheet

When a company issues equity or preferred shares, the company receives cash, which is an asset. Since the company is liable to the shareholders, the share capital is a liability.

This is a significant jump from the 3.9% rate the company had previously been paying. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Common equity is important in preparing an investment roadmap for investors looking to invest in a company. The material provided on this website is for informational use only and is not intended for financial, tax or investment advice. Bank of America and/or its affiliates, and Khan Academy, assume no liability for any loss or damage resulting from one’s reliance on the material provided.

For more business financing tips

WPG held $950 million in debt at the time of bankruptcy. While commercial real estate companies are often highly leveraged, there is a risk that unexpected events can inhibit their ability to repay debts.

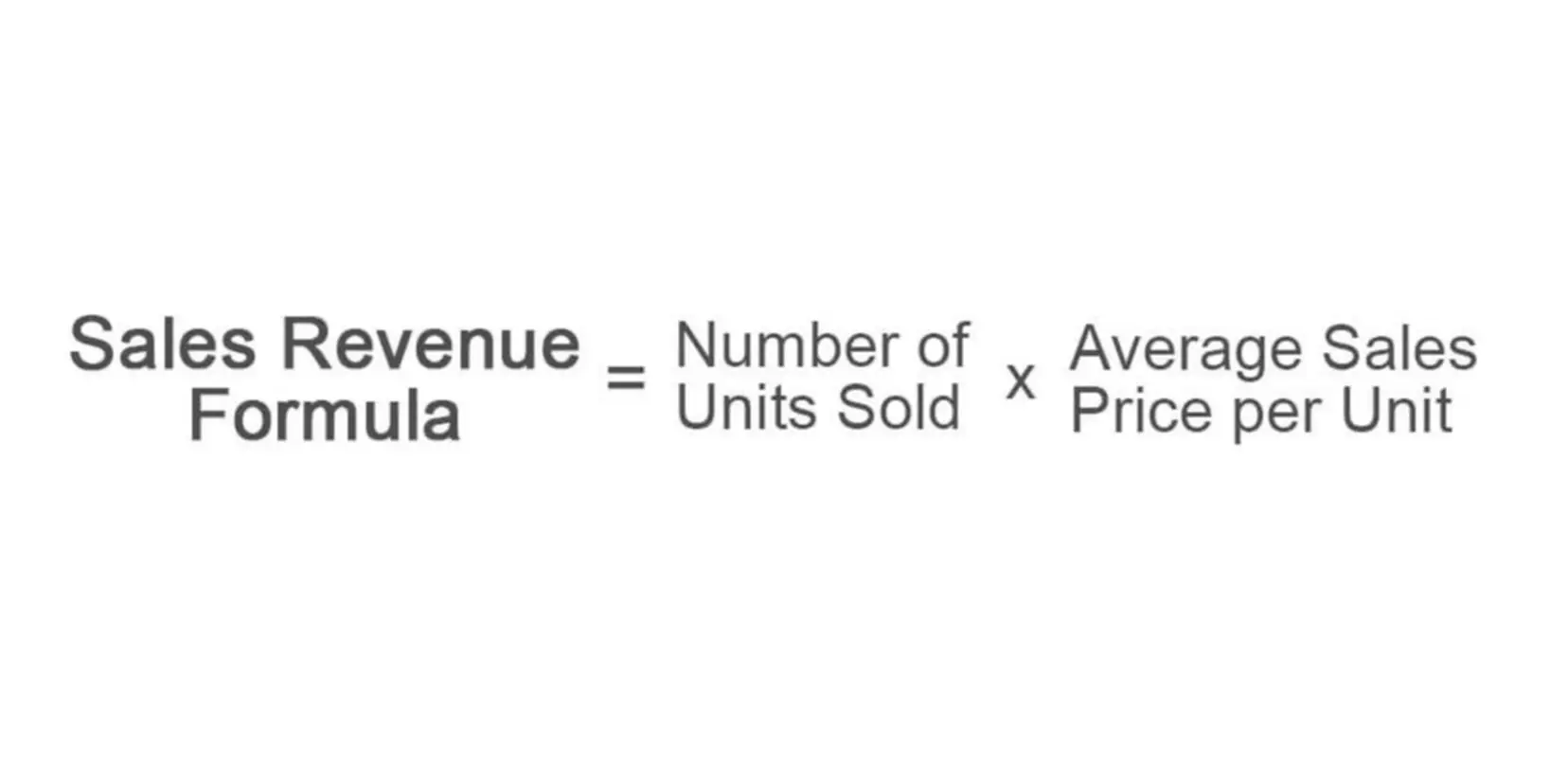

So we always start by How to Calculate Total Equity the market value of equity. Then enterprise value represents net operating assets to all investors. So we subtract non-operating or non-core assets, and then we add liability and equity line items that represent different investor groups in the company. And we went over some common examples of what you add and subtract in this calculation. Now we’re going to see it executed in real life for these companies. As always, I have some detailed notes under each company’s example that explains why we are adding, subtracting, or ignoring certain things. The above formula is known as the basic accounting equation, and it is relatively easy to use.