In addition, certain differences exist between the detailed requirements of IAS 7 and ASC 230, which could affect dual preparers. See KPMG Handbook, Statement of cash flows, to learn more about the US GAAP requirements. Interest expense is classified as an operating cash flow on the cash flow statement. It represents the cost of borrowing, and changes in interest rates can impact a company’s overall cash flow. By examining interest expense on the cash flow statement, you can gain insight into how much a company is spending on financing activities relative to its operating income.

The cash flow statement reflects the actual amount of cash the company receives from its operations. By calculating the total amount paid for an interest expense, individuals can get a better understanding of their overall financial situation and make informed decisions about their future finances. This calculation can help them plan ahead and set aside money they may need in order to pay off any additional expenses they may incur in the future. The interest expense is calculated on the borrowed funds of an entity. The interest is payable on the bonds, convertible bonds, bank loans, and lines of credit. The total interest expense of the company is calculated on the net borrowings.

Cash Interest Vs. Interest Expense: How Are They Different

This makes it simple to track and manage a business, which is advantageous for them. The cost of interest expenses is an important factor to consider when budgeting for a business. Next, consider how interest expense compares to other items on the cash flow statement.

Demand deposits are not defined in IFRS Accounting Standards, but we believe they should have the same level of liquidity as cash and therefore should be able to be withdrawn at any time without penalty. Diversity in practice may have developed because IAS 7 refers to ‘profit or loss’, but an example to the standard starts with a different figure (profit before taxation). We believe it is more appropriate to follow the standard (i.e. start with profit or loss), because the example is illustrative only and does not have the same status as the standard. In this blog, we have tried to explain the concept of interest expense in detail. The accounting nature of interest, treatment, calculation and general rules regarding the recording of interest expense has been discussed. There is a difference between International Financial Reporting Standards and the US Generally Accepted Accounting Principles.

The first way is to report the total amount of interest payments made during the period under the ‘Financing Activities’ section. This method will show how much was paid in interest over the course of that period. Alternatively, if more detail is required, individual payments can be tracked and reported separately under either ‘Operating Activities’ or ‘Financing Activities’ depending on their source. All cash flows are classified under operating, investing and financing activities as discussed below. This is usually done as supplementary information at the end of the statement of cash flows or in the notes to the financial statements.

Operating Activities in the Cash Flow Statement

However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. While the majority of the members say that because this interest comes from in the normal course of business. At the voting, the members with the second view have more votes than the first. That’s why it is included in the operating activities of the cash flow.

Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements (see below). Investing activities include any sources and uses of cash from a company’s investments. Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category.

- Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments.

- Apart from companies, interest expense is also prevalent for other entities.

- Interest paid is a part of operating activities on the statement of cash flow.

- An interest expense is an amount that is paid by a company as a result of borrowing money.

- Practically, however, companies will also have opening interest payable balances.

It provides all the summarized information about the cash receipt and payment. Regardless of the method, the cash flows from the operating section will give the same result. Next, you will want to add up all of the payments made on the interest expense over that period. This will give you an understanding of how much money was actually paid out for the interest expense over that period. Once this figure has been calculated, it can be used as an indication of how much money is being put towards paying off this particular expense. Interest expense is the total interest expense due for a certain financial period.

These guidelines ensure consistency and transparency in financial reporting. So join us as we navigate through the intricacies of where interest expense lies within the realm of the cash flow statement, giving you greater freedom in assessing a company’s financial performance. Cash flow statement is a report wherein cash inflow and outflow related to the company activities are summarized. Three main cash flow activities are operating, financing and investing. They always need finances to meet the needs of expanding the business.

Proposed amendments and other future developments

Before this model can be created, we first need to have the income statement and balance sheet built in Excel, since that data will ultimately drive the cash flow statement calculations. Cash spent on purchasing PP&E is called capital expenditures (CapEx). These investments are a cash outflow, and therefore will have a negative impact when we calculate the net increase in cash from all activities. The items in the operating cash flow section are not all actual cash flows but include non-cash items and other adjustments to reconcile profit with cash flow. Interest paid is a part of operating activities on the statement of cash flow.

Cash flows are classified as either operating, investing or financing activities, depending on their nature. In conclusion, understanding the placement of interest expense on the cash flow statement is crucial for interpreting its impact on cash flow. By analyzing this information strategically, you can gain insights into a company’s financial health and its ability to generate sufficient cash to cover its interest obligations. This analytical approach allows for concise evaluation of interest expense and aids in making informed investment decisions. Interest expense is different from other expenses on the cash flow statement because it represents the cost of borrowing money.

Limitations of the Cash Flow Statement

Additionally, any interest expense must be added back, as it is a non-operating expense. The reason why interest expense is added back to cash flow from operating activities is because it is a non-operating expense. This means that it is not directly related to a company’s core business operations. As such, it can be misleading to include interest expense when trying to assess a company’s ability to generate cash from its core business operations.

Trinity Industries, Inc. Announces Second Quarter 2023 Results – InvestorsObserver

Trinity Industries, Inc. Announces Second Quarter 2023 Results.

Posted: Tue, 01 Aug 2023 10:55:45 GMT [source]

Interest expense is an essential component of a company’s cash flow statement as it directly affects the amount of cash available for other purposes. When interest expenses increase, it can reduce the amount of cash generated by operating activities, thereby limiting funds that could be used for business growth or dividend payments. Conversely, decreasing interest expenses can have a positive impact on cash flow, providing more flexibility to allocate resources. The placement of interest expense on the cash flow statement provides valuable insights into a company’s financial health, allowing stakeholders to make informed decisions about its future prospects and risks.

In these cases, revenue is recognized when it is earned rather than when it is received. This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations. If the starting point profit is above interest and tax in the income statement, then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows. Clearly, the exact starting point for the reconciliation will determine the exact adjustments made to get down to an operating cash flow number. The value of various assets declines over time when used in a business.

This includes any dividends, payments for stock repurchases, and repayment of debt principal (loans) that are made by the company. In most cases, adp run review these are the only adjustments to reach interest paid. Usually, the opening and closing interest payables come from the balance sheet.

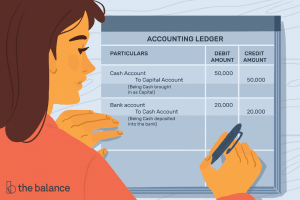

As we have discussed, the operating section of the statement of cash flows can be shown using either the direct method or the indirect method. With either method, the investing and financing sections are identical; the only difference is in the operating section. The direct method shows the major classes of gross cash receipts and gross cash payments. Under the accrual method of accounting, interest expense is reported on a company’s income statement in the period in which it is incurred.

- In short, changes in equipment, assets, or investments relate to cash from investing.

- ABC Co. will add $200,000 back to its net profits under cash flows from operating activities.

- Interest expense can be classified as an operating, investing, or financing activity on the cash flow statement depending on the nature of the interest.

- Under IFRS, there are two allowable ways of presenting interest expense or income in the cash flow statement.

- Operating activities are made up mainly of the working capital or you can say that it mainly consists of changes in current assets and current liabilities of the balance sheet.

- Dividends, interest, and interest payments are all part of operating cash flows.

Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders, the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity. The operating activities on the CFS include any sources and uses of cash from business activities. In other words, it reflects how much cash is generated from a company’s products or services.